How Can Your Company Get Involved in the Belt and Road Initiative?

This article will:

Question the assumptions often made about the BRI;

Highlight successful case studies of companies benefiting from BRI;

Describe 3 steps in which you can start to benefit from BRI.

Five years since its announcement, the publicity received by the Belt and Road Initiative (BRI) has been steadily growing. The initiative covers 67% of the world’s population, almost 35% of world GDP and around 40% of world trade. BRI comprises multiple infrastructure projects across Eurasia, Africa and beyond, and hopes to boost China’s trade relations with the world.

The scale of the Belt and Road Initiative

Source: Belt and Road Advisory “Belt and Road 101” Report

We’re still in the early stages, but even now it is clear the scale of the initiative is unprecedented. If successful, the BRI will have profound impacts around the world.

“The Belt & Road Initiative (BRI) is by far the largest coordinated infrastructure investment program in human history. Never has spending on connectivity been more essential to overcome borders, enhance efficiencies, raise productivity, grow the world economy, and build a global civilization.”

The Map of the Belt and Road Initiative

Source: Belt and Road Advisory “Belt and Road 101” Report

But if BRI is an undertaking of such scale and transcends borders, why has it largely been neglected by foreign business as a major commercial opportunity?

There are three main reasons.

First, there is a perception problem. BRI is often portrayed as solely a strategy that supports China’s geopolitical ambitions. As a result, BRI is seen primarily in the context of international politics, not international business.

Second, there is a problem of communication. There is no clear, official channel explaining how foreign businesses can get involved with BRI. Instead, China has branded BRI with political slogans that have been met with skepticism from the foreign business community.

Finally, the common understanding of BRI projects are that they are focused on infrastructure and built almost exclusively by Chinese companies.

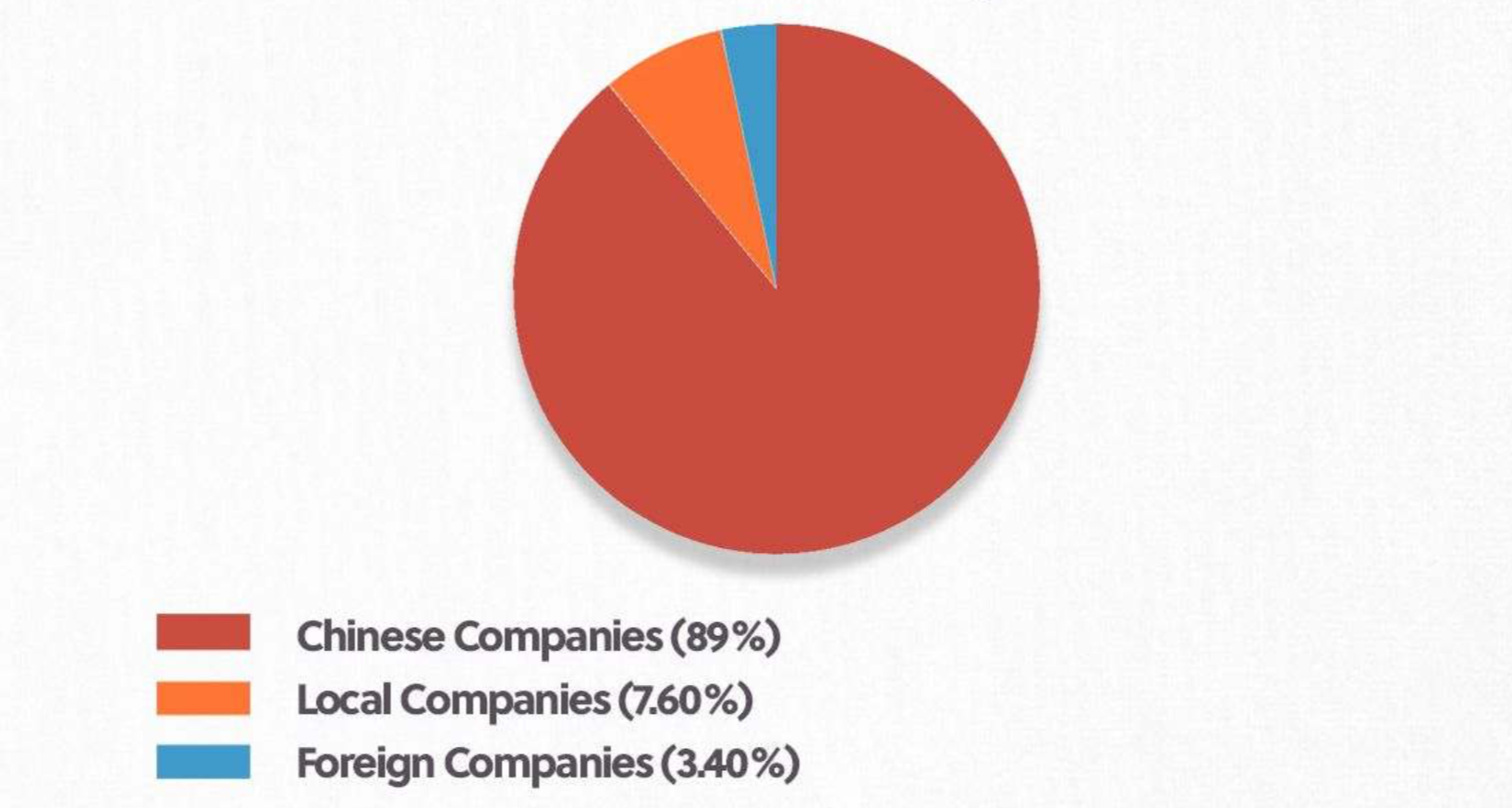

Who runs BRI Projects?

Source: Belt and Road Advisory “Belt and Road 101” Projects

Combined, these three points explain the lack of enthusiasm that many international business leaders have had towards BRI. And that perception is stopping them from thinking in a more nuanced manner about BRI and exploring relevant opportunities.

Yet, there is no universal formula for foreign firms when engaging with BRI. Instead, to benefit from BRI, you need your own strategy that is based on a solid understanding of what Belt and Road projects exist/are under construction, and what the effects of those projects are going to be on the local economy. And we have seen examples of foreign companies doing exactly that.

For example, Honeywell, an American Fortune 100 company, is a leader in the nexus of physical and digital infrastructure for energy, security and urbanization projects. The company has been providing supervisory control and data acquisition solutions for Chinese infrastructure projects run by Huawei and China National Petroleum Company across Central Asia effectively ensuring the safety measures for gas and oil projects in the region. This initial collaboration allowed Honeywell to later enter into a major partnership with Huawei jointly developing smart building offerings. Honeywell identified the gaps in the know-how of Chinese firms running BRI projects and exploited the opportunity accordingly.

“We’ve created programs with the Chinese, and especially added the One Belt, One Road to that, which has really increased significantly our presence in the former CIS states, in Turkmenistan, Kazakhstan, in Azerbaijan, et cetera, whether it’s a gas pipeline or new installations for oil and gas”

Among European players, Siemens has created its own BRI strategy. In 2017, the German giant established its own Beijing based company-wide Belt and Road Task Force responsible for seeking synergies between the company and the BRI. In June 2018, the company organized its Belt and Road International Summit which allowed the company to enter over 10 agreements with Chinese partners. These involved carrying out projects in Indonesia, the Philippines, Nigeria, Mozambique, and South America.

“BRI has proven to be a wise and powerful force for accelerating infrastructure development already in many participating countries. Siemens is uniquely positioned to help ensure sustainable success of the BRI through its vast technology portfolio, in-depth knowledge of local market needs.”

But benefiting from BRI is not just restricted to large multinationals. BRI infrastructure projects should also be assessed on the secondary effects that they have on the local economy and wider business environment. More often than not, infrastructure catalyzes positive growth effects on the local economy that foreign firms, particular SMEs, can then tap into. For example, faster are now permitting the export of more European products to China.

The development of EU-China railway links have been promoted under the Belt and Road umbrella, and now more direct train connections are being launched between Chinese and European cities. Logistics companies have adapted accordingly; for example, German logistics company DHL has added 6 new connections to its portfolio and launched a door-to-door service between Europe and China. The China-Europe rail link is currently 12,000 km long and it allows transport of goods two times faster than by sea at a price six times cheaper than by air.

The growing popularity of these new logistics solutions is related to the fact that the railway connection is faster than sea freight and cheaper than air transport. With demand set to increase by over 30% by 2020, and the corresponding emergence of new logistics providers, freight costs associated with using the railway are set to decline further. Retail businesses, including those specializing in perishable agricultural products, can benefit from this cheaper and more reliable rail solution.

Alongside a faster railway link into China, European companies looking to tap into the growing Chinese market can also take advantage of the development of cross-border e-commerce, pioneered by Chinese giant Alibaba.

Since 2015, Alibaba has been setting up digital national pavilions within their Tmall Global platform which has helped foreign goods reach Chinese customers. The platform offers a special incubation program to reduce the complexity of selling to China. In 2017 alone, over 365 foreign companies were successfully incubated through the platform.

So thinking about how to make use of new physical and digital infrastructure channels is the first step for foreign enterprises thinking to benefit from the BRI. Given this is still early days for the BRI, embracing these channels and developing a company-specific strategy will enable you to exploit first-mover advantage and tap into new opportunities being unlocked in this age of connectivity. For large and established players, tapping into billion dollars plus BRI projects as a sub-contractor is an option, especially in areas where Chinese firms lack the know-how. For smaller firms, the opportunities come from riding the trends and benefiting from the positive spillover effects brought about through new infrastructure.

Click here to get a free copy of “Belt and Road 101”, a report introducing the Belt and Road Initiative to business.

*

This article is part of “China-EU BRI Business Series” released by the Belt and Road Advisory

in cooperation with the Benelux Chamber of Commerce